Is Your Manufacturing Company a Value Leader?

With 22 years of executive search and consulting experience focused on increasing enterprise value in the printing industry, plus another 18 years in executive sales management at Moore Business Forms & Systems, I have had the pleasure of meeting hundreds of owners of print, promo, paper and packaging companies.Most owners are great salespeople; some have a more operational or engineering expertise, others more technology. Some run average companies, some profitable companies, but very few are value leaders.The question that comes to mind that this article will help answer: What is a value leader, and why should owners strive to become one?In many ways, the process of moving from one level of business value to another is like the movement of several different vehicles, each having its own medium to navigate through, environmental conditions to deal with and speed it can accomplish. Figure 1 provides a characterization of the magnitude of four different levels of business value for a company starting at the bottom of the hierarchy:

A Below Average Company:

Essentially a company underwater. Like a submarine, it is still alive and able to navigate from one position to another, but it has limited visibility, and its speed is impacted by all the fluid around it. The vehicle is not particularly efficient in getting from one point to another and must come up for air occasionally to survive.

An Average Company:

It’s above water, can move without a great deal of effort from one position to another by adjusting the sails, but it requires tacking to get to its desired location due to external elements that influence it, like wind speed and direction. The craft requires a knowledgeable captain to instruct a crew on what to do, but pretty much must go with the flow as efficiently as possible.

A Profit Leader:

An efficient company that knows where it’s going, can get there quickly, has a highly trained pilot, and is a product of considerable design, investment and support. It is sophisticated with guidance systems that help with visibility, navigation and maneuvering through difficult competitive environments.

A Value Leader:

Essentially a company that operates in the stratosphere. Its pilot is not a single owner, but a team of experts that communicate with the vehicle effectively through instruments as it travels at incredible speeds in its well-defined orbit. It has all the gadgets to monitor key performance indicators important to diagnosing problems before they become major issues. They are leaders in the industry, already thinking of new products, services and enhanced ways of doing business and do not rely on their previous track record for their future success.

So how does an owner move up the value scale from being a below average or average company, to a Profit Leader or Value Leader?

Step 1: Getting to Average Performance

A company operating at below-average margins typically has something fundamentally wrong with management, product cost, product quality/service, pricing and/or service offerings. In many ways, getting to an average performance level requires an understanding of what is wrong (the “what”) and how to deal with it (the “how”). Benchmarking the details of the under-performing company against other similar businesses often provides some clues as to where to prioritize the attention, but doing things right often requires a fresh perspective, industry experience and often the organization’s willingness to change, especially if it means change of company culture. When something is fundamentally wrong, continuing to do it the same way is a sure path to a company fire sale. In the long run, the issue becomes the owner’s willingness to change in order to survive versus sinking underwater as competitive pressures increase.

Step 2: Going from an Average Company to a Profit Leader

In general, there are four major factors that contribute to achieving profitable success:

- Optimizing product and customer mix

- Constant cost reduction

- Enhancing value proposition/branding

- Implement business process optimization

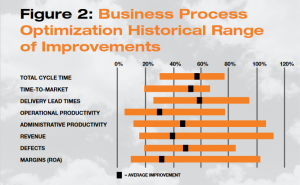

Many owners consider the first three as a matter of course in managing their businesses but often are not aware of the value that re-engineering administrative and production processes can have on quality, cycle time and efficiency of the business. Management, customers and products change; however, processes haven’t always evolved in the most efficient way. There are significant gains that come from improving under-performing processes, functions and assets, as well as efficiencies in doing both the right things and doing things right.

Figure 2 illustrates the kinds of improvement that a successful business process optimization effort can produce over a two-year period.  Customer value-based pricing, maximizing product and customer mix, constant cost reduction, enhancing value proposition and achieving business process optimization is the gateway to running a tight ship and profit leadership.

Customer value-based pricing, maximizing product and customer mix, constant cost reduction, enhancing value proposition and achieving business process optimization is the gateway to running a tight ship and profit leadership.

Step 3: Becoming a Value Leader

The last step in the value enhancement process for an owner is focusing on those things that impact the enterprise value in the eyes of a potential buyer. Yes, size and profitability are important, yet there are other intrinsic factors that need to be considered. Buying a home is an emotional decision; however, buying a business is an investment decision. Here the focus is not only on size, margin and efficiency, but on the risks involved in creating a stream of profits that can be counted on long term to generate the return for what is invested. Investors have lots of options for where to invest, and their money is going to go to the place that provides the best return for the least risk.

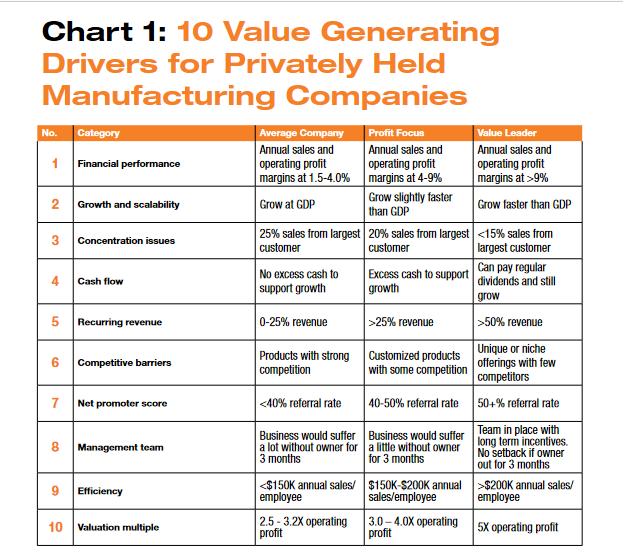

Reducing the risks involved, plus generating a healthy cash flow, is what gives rise to valuation multiples for middle market privately held companies. Profit Leaders may have a valuation that averages around 3.3X multiple of operating income, a Value Leader typically has a 5X multiple.

Most investment models consider eight to 10 key value drivers that contribute to becoming a Value Leader. Each has several additional dimensions and levels that give it character and better definition. Chart 1 shows the sensitivity of one valuation model developed by John Warrillow, author of “Built to Sell,” specifically focused on the manufacturing industry. This model is based on input from over 1,000 privately held business owners who have received offers for their companies in the last 18 months.

Conclusion

If you are a future seller, no one is going to pay for the time and effort you put into the business; they will only pay for the value they perceive they can get out of it. The good news is that based on the application of benchmarking, business process optimization, and de-risking, middle-market companies in the commercial print space have a significant opportunity for owners to increase the enterprise value of their companies. If you haven’t undergone a value builder evaluation effort recently, it might be time to see what can be gained by getting some assistance in this area. Utilize a professional coach that can help you understand all the investment risks associated with your business today and how to minimize them in the future. In addition, one book I recommend you may read to get a grip on what you need to know is “You Don’t Know What You Don’t Know” by Terry Lammers.Benchmarking, business process optimization and de-risking the business are three key areas needed to move the business up the value chain from an average company to a Profit Leader company and ultimately to a Value Leader. In business, when it comes time to sell, profit-focused companies will get you a good price; however, a high valued leader with minimum risk will capture the ultimate premium.

Gary Bozza, CEO & Managing Partner of WorldBridge Partners Chicago NW, has been winning industry awards and recognitions in talent acquisition for the last 26 years, following a highly successful 18-year career as Vice President of National Accounts and Director of Midwest Sales primarily at MOORE (now RR Donnelley). Gary’s business is dedicated to helping Owners, CEOs and Presidents hire industry talent, drive new revenue, optimize operations, and maximize enterprise valuation. His firm specializes in executive recruitment and coaching owners on how to improve the eight key drivers of business value from the “buyer’s eyes.”

Contact Gary today at (847) 550-1300 ext. 33 or [email protected]